MetLife 403BHARDSHIPWD 2008-2026 free printable template

Show details

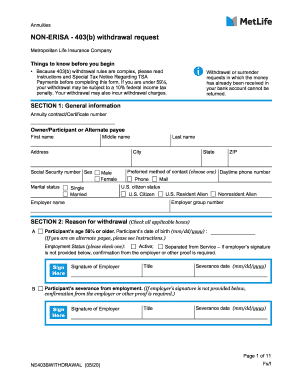

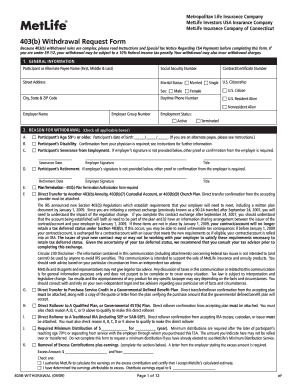

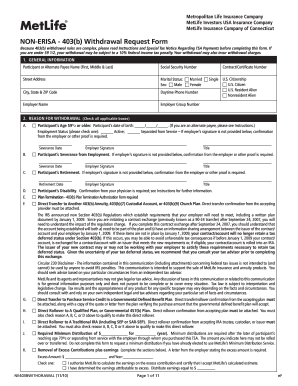

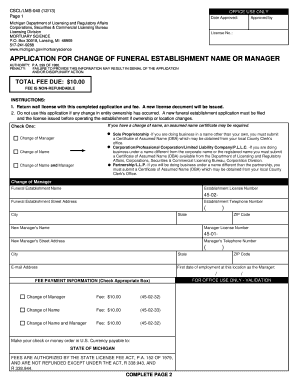

Metropolitan Life Insurance Company MetLife Investors USA Insurance Company MetLife Insurance Company of Connecticut 403(b) Hardship Withdrawal Request Form 1. GENERAL INFORMATION (Complete all applicable

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 403b withdrawal form

Edit your metlife annuity withdrawal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b withdrawal request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit metlife withdrawal form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit metlife 403b withdrawal form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out metlife hardship withdrawal form

How to fill out MetLife 403BHARDSHIPWD

01

Download the MetLife 403B Hardship Withdrawal form from the MetLife website or request a copy from your employer.

02

Carefully read the instructions provided with the form to understand the eligibility requirements for a hardship withdrawal.

03

Fill in your personal information, including your full name, Social Security number, and account number.

04

Indicate the specific reason for the hardship withdrawal by selecting the appropriate option on the form.

05

Provide any supporting documentation required for the stated hardship, such as medical bills or proof of financial need.

06

Review the completed form for accuracy and completeness, ensuring all necessary signatures are included.

07

Submit the form and supporting documents to the designated MetLife address or your employer's HR department for processing.

Who needs MetLife 403BHARDSHIPWD?

01

Individuals enrolled in a MetLife 403B plan who are experiencing financial hardship.

02

Participants who need to access their retirement savings for specific qualifying expenses as outlined by IRS regulations.

Fill

403 b hardship form

: Try Risk Free

People Also Ask about 403 b withdrawal request

What is the penalty for cashing out a 403b?

A plan distribution before you turn 65 (or the plan's normal retirement age, if earlier) may result in an additional income tax of 10% of the amount of the withdrawal.

How do I withdraw money from my 403b?

In addition to loans and hardship distributions, a 403(b) plan may allow employees to take money out of the plan when they: reach age 59½; have a severance from employment; become disabled; die; or. encounter a financial hardship.

What tax document do I need for 403b withdrawal?

If you received distributions from your retirement accounts, you will receive Form 1099-R.

Can I transfer my 403b to my bank account?

Transfer to a Bank Account To do so, you would request that the funds be paid to you directly—not to another retirement account. But if you have pre-tax money in the plan (and other money types), you might owe taxes when you withdraw the money.

How much tax will I pay if I cash out my 403b?

Federal tax law requires that most distributions from qualified retirement plans that are not directly rolled over to an IRA or other qualified plan be subject to federal income tax withholding at the rate of 20%.

What is the tax rate for cashing out a 403b?

Federal tax law requires that most distributions from qualified retirement plans that are not directly rolled over to an IRA or other qualified plan be subject to federal income tax withholding at the rate of 20%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get metlife non erisa 403 b withdrawal request?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 403b hardship withdrawal form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the how to fill out metlife 403bhardshipwd as outlined by irs regulations electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete metlife notice to withdraw form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your metlife annuity withdrawal form pdf. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is MetLife 403BHARDSHIPWD?

MetLife 403BHARDSHIPWD is a withdrawal form specifically designed for participants in 403(b) retirement plans to request a hardship distribution from their account.

Who is required to file MetLife 403BHARDSHIPWD?

Any participant in a 403(b) retirement plan who is seeking a hardship distribution to address immediate and pressing financial needs must file the MetLife 403BHARDSHIPWD.

How to fill out MetLife 403BHARDSHIPWD?

To fill out MetLife 403BHARDSHIPWD, you must provide personal information, specify the reason for the hardship, and include any required documentation to support your withdrawal request.

What is the purpose of MetLife 403BHARDSHIPWD?

The purpose of MetLife 403BHARDSHIPWD is to allow participants to access their retirement savings in cases of financial hardship, as permitted under IRS regulations.

What information must be reported on MetLife 403BHARDSHIPWD?

The information that must be reported on MetLife 403BHARDSHIPWD includes personal identification details, the reason for the hardship request, and any relevant supporting documentation.

Fill out your MetLife 403BHARDSHIPWD online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Metlife 403b is not the form you're looking for?Search for another form here.

Keywords relevant to 403bhardshipwd 403b withdrawal

Related to site pdffiller com inurl metlife

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.